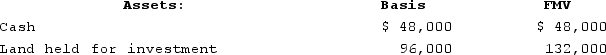

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prior to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

Definitions:

Past Participle

A grammatical form of a verb used in forming perfect and passive tenses and sometimes as an adjective.

Fire Stations

Facilities that house firefighters and their equipment, serving as a base for responding to fires and emergencies.

Livermore

A city in California, known for its wineries, technology firms, and the Lawrence Livermore National Laboratory.

Past Participle

A verb form typically used in perfect tenses and passive voice, often ending in -ed, -en, -d, -t, or -n.

Q9: Suppose that at the beginning of 2020

Q11: Kathy purchases a one-third interest in the

Q39: Tennis Pro, a Virginia corporation domiciled in

Q55: Nadine Fimple is a one-half partner in

Q61: Bruin Company reports current E&P of $340,000

Q66: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q74: On 12/31/X4, Zoom,LLC, reported a $54,000 loss

Q77: Which of the following tax benefits does

Q81: Which of the following isn't a criterion

Q106: Billie transferred her 20 percent interest to