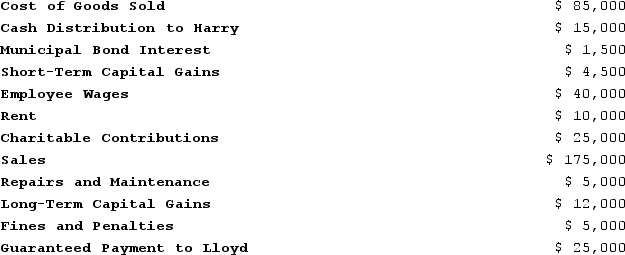

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Definitions:

Interview

A formal meeting in which one or more persons question, consult, or evaluate another person.

Situational Interview

A type of job interview where candidates are asked to describe how they would respond to hypothetical job-related scenarios.

Business Details

Specific facts or pieces of information related to the operation, strategies, or background of a company.

Common Sense

Practical judgment concerning everyday matters or basic intelligence that is shared by a significant number of people.

Q2: During 2020, MVC operated as a C

Q17: At the end of Year 1, Tony

Q30: Roxy operates a dress shop in Arlington,

Q32: Which of the following statements concerning the

Q57: Tyson is a 25percent partner in the

Q68: Leonardo, who is married but files separately,

Q94: Which of the following statements does not

Q95: Illuminating Light Partnership had the following revenues,

Q102: The effective tax rate, in general, provides

Q113: Yellow Rose Corporation reported pretax book income