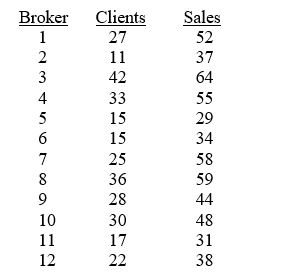

TABLE 13-4

The managers of a brokerage firm are interested in finding out if the number of new clients a broker brings into the firm affects the sales generated by the broker. They sample 12 brokers and determine the number of new clients they have enrolled in the last year and their sales amounts in thousands of dollars. These data are presented in the table that follows.

-Referring to Table 13-4, the managers of the brokerage firm wanted to test the hypothesis that the population slope was equal to 0. At a level of significance of 0.01, the decision that should be made implies that ________ (there is a or there is no) linear dependent relationship between the independent and dependent variables.

Definitions:

Time Inconsistency

The tendency of certain conditions or decisions to change over time, especially in the context of economic planning and policy-making.

Prospect Theory

A behavioral economics theory of preferences having three main features: (1) people evaluate options on the basis of whether they generate gains or losses relative to the status quo; (2) gains are subject to diminishing marginal utility, while losses are subject to diminishing marginal disutility; and (3) people are prone to loss aversion.

Behavioral Economists

Economists who study how psychological, social, cognitive, and emotional factors affect economic decisions and market outcomes.

Availability Heuristic

A mental shortcut that relies on immediate examples that come to mind when evaluating a specific topic, concept, method, or decision.

Q17: Referring to Table 13-5,the standard error of

Q48: Referring to Table 12-11,the expected cell frequency

Q56: Referring to Table 12-14,the director now wants

Q101: Referring to Table 12-5,there is sufficient evidence

Q102: Referring to Table 13-13,the value of the

Q110: Referring to Table 11-6,using an overall level

Q118: Referring to Table 13-3,the director of cooperative

Q134: Referring to Table 13-5,the partner wants to

Q330: Referring to Table 14-8,the analyst wants to

Q338: Referring to 14-16,what is the p-value of