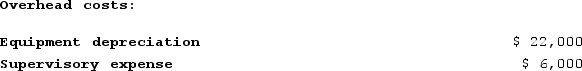

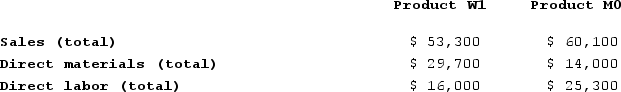

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

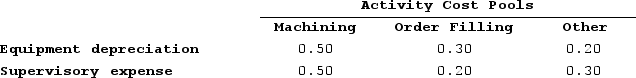

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

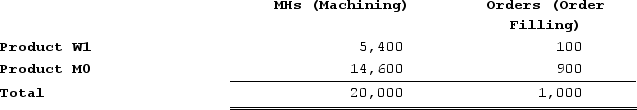

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data: What is the product margin for Product W1 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

What is the product margin for Product W1 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

Definitions:

Functional

Relates to the specific role or purpose something serves within a larger system or structure.

Divisional

Pertains to a business structure where operations are segmented based on product lines, markets, or geographical areas.

Geographical Structures

Organizational structures that are arranged based on geographical regions or territories.

Market Area

A geographical region or demographic group in which a company's products or services are marketed and sold.

Q6: Bachrodt Corporation uses activity-based costing to compute

Q25: Doede Corporation uses activity-based costing to compute

Q27: Kolstad Clinic uses patient-visits as its measure

Q61: Parwin Corporation plans to sell 23,000 units

Q66: The Puyer Corporation makes and sells only

Q171: In a Cost Analysis report in time-based

Q265: Coles Corporation, Incorporated makes and sells a

Q304: Aaron Corporation, which has only one product,

Q329: Wedd Corporation uses activity-based costing to assign

Q352: Eccles Corporation uses an activity-based costing system