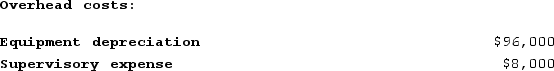

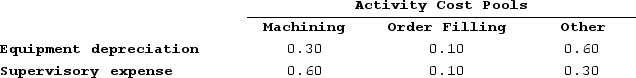

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

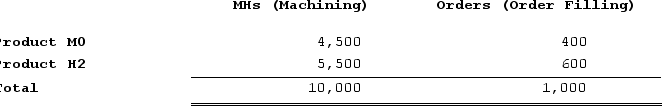

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

Definitions:

Illusory Promise

A statement that appears to be a promise but does not actually bind the party to any obligation, making it unenforceable as a contract.

Liquidated Debt

A debt or claim whose precise monetary value has been determined, acknowledged, or agreed upon by all involved parties.

Performance

The act of carrying out or accomplishing an action, task, or function.

Equitable Principles

Principles based on fairness, morality, and justice rather than strict rules of law.

Q36: Luckman Corporation bases its budgets on the

Q96: Capes Corporation is a wholesaler of industrial

Q104: Flemming Corporation uses activity-based costing to compute

Q128: A reason why absorption costing income statements

Q226: Meester Corporation has an activity-based costing system

Q292: Brester Corporation is conducting a time-driven activity-based

Q335: The Southern Corporation manufactures a single product

Q340: Monfort Corporation is conducting a time-driven activity-based

Q355: A manufacturing company that produces a single

Q376: Lysiak Corporation uses an activity based costing