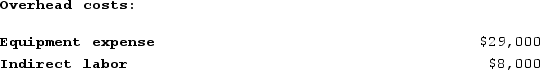

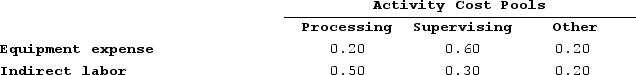

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

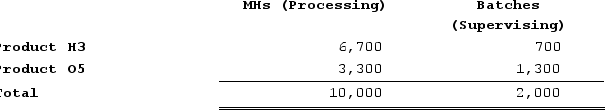

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Book Value

Book value represents the value of an asset according to its balance sheet account balance, taking into account the original cost minus depreciation, amortization, or impairment costs.

Amortized

Adjusted through gradual reduction of the loan balance or asset value over time by making regular payments that cover both principal and interest.

Goodwill

An intangible asset that arises when a business is purchased for more than the fair value of its net identifiable assets.

Q1: Hagy Corporation has an activity-based costing system

Q58: Guerra Electronics manufactures a variety of electronic

Q131: The LaGrange Corporation had the following budgeted

Q136: Higado Confectionery Corporation has a number of

Q146: Krepps Corporation produces a single product. Last

Q188: Which of the following would be classified

Q191: Chaudhuri Memorial Diner is a charity supported

Q223: Sleeter Corporation makes one product and it

Q245: Under the LIFO inventory flow assumption, if

Q268: Doede Corporation uses activity-based costing to compute