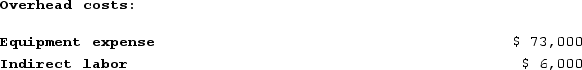

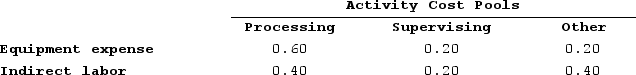

Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

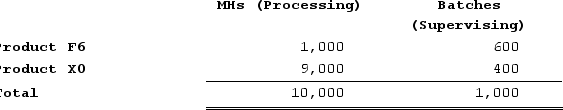

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

Definitions:

FIFO

An inventory valuation method where the first items produced or purchased are the first sold, leading to inventory being valued at approximate recent costs.

LIFO

An inventory valuation method that assumes the last items added to the inventory are the first ones to be sold ("Last In, First Out").

Weighted Average

A calculation that takes into account the different degrees of importance of the numbers in a dataset, making some values count more heavily than others.

Cost Flow Assumption

Accounting methods used to determine the cost of goods sold and ending inventory, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out).

Q35: An activity-based costing system that is designed

Q38: Deemer Corporation has an activity-based costing system

Q52: Lamorte Corporation is conducting a time-driven activity-based

Q57: Mansour Memorial Diner is a charity supported

Q115: Wolanski Corporation has provided the following data

Q126: Elbrege Corporation manufactures a single product. The

Q147: Tustin Corporation has provided the following data

Q237: Michard Corporation makes one product and it

Q252: Hennagir Corporation makes one product and has

Q297: Choi Corporation is conducting a time-driven activity-based