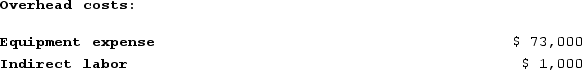

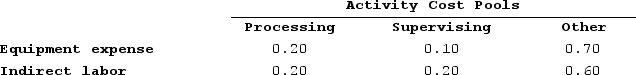

Addleman Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

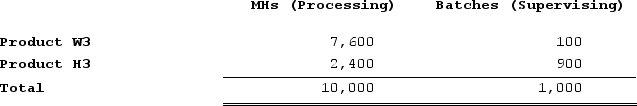

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

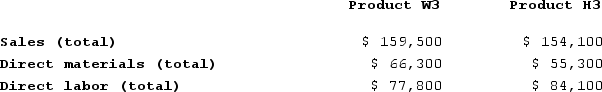

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data:

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data: What is the overhead cost assigned to Product H3 under activity-based costing?

What is the overhead cost assigned to Product H3 under activity-based costing?

Definitions:

Accounts Receivable

Money owed by customers to a company for goods or services provided on credit.

Notes Receivable

A customer’s written promise to pay an amount and possibly interest at an agreed-upon rate.

Allowance Method

The method of accounting for uncollectible accounts that provides an expense for uncollectible receivables in advance of their write-off.

Receivables

All money claims against other entities, including people, business firms, and other organizations.

Q1: Sevenbergen Corporation makes one product and has

Q27: Pierceall Corporation is conducting a time-driven activity-based

Q49: Smith Corporation makes and sells a single

Q64: Moorman Corporation has an activity-based costing system

Q72: Offerman Corporation is conducting a time-driven activity-based

Q88: Hane Corporation uses the following activity rates

Q191: Chaudhuri Memorial Diner is a charity supported

Q206: Krepps Corporation produces a single product. Last

Q208: Reck Corporation uses activity-based costing to assign

Q348: Handal Corporation uses activity-based costing to compute