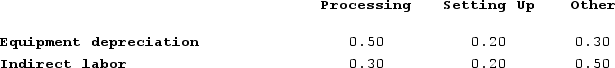

Moorman Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $62,000 and indirect labor totals $2,000. Data concerning the distribution of resource consumption across activity cost pools appear below:

Required:Assign overhead costs to activity cost pools using activity-based costing.

Required:Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Writer-Focused Statements

Statements in which the author's perspective, opinions, or personal experiences are the primary focus, potentially at the expense of the audience's engagement.

Professional Portfolio

A collection of work and achievements demonstrating a person's skills, accomplishments, and professional experience.

Workshops Attended

Participatory meetings or sessions in which individuals engage in intensive discussion and activity on a particular subject or project.

Income Tax Statements

Documentation filed with government authorities that report income earned and taxes owed for a specific period.

Q12: Quates Corporation produces a single product and

Q109: Aaron Corporation, which has only one product,

Q154: Meester Corporation has an activity-based costing system

Q172: Sorice Corporation uses activity-based costing to assign

Q195: Fernstrom Corporation has two divisions: East and

Q255: Drucker Corporation manufactures and sells one product.

Q303: Baughn Corporation, which has only one product,

Q342: Lamorte Corporation is conducting a time-driven activity-based

Q361: Cahalane Corporation has provided the following data

Q368: Lemaire Corporation is conducting a time-driven activity-based