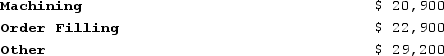

Flemming Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

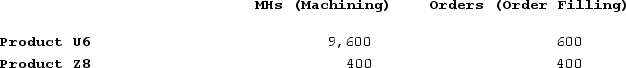

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

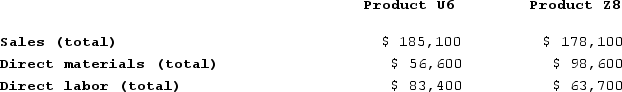

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins. The activity rate for Machining under activity-based costing is closest to:

The activity rate for Machining under activity-based costing is closest to:

Definitions:

Civil Liberties

Individual rights protected by law from unjust governmental or other interference.

Civil Rights

Rights protecting individuals' freedom and ensuring equal treatment under the law, regardless of race, gender, disability, or other characteristics.

Brown v. Board

The 1954 Supreme Court case that declared state laws establishing separate public schools for black and white students unconstitutional.

Landmark Decision

A court ruling that marks a significant change in the interpretation of the law or sets a new precedent.

Q15: Imbesi Corporation is conducting a time-driven activity-based

Q27: Pierceall Corporation is conducting a time-driven activity-based

Q33: The cash budget is the starting point

Q43: Michard Corporation makes one product and it

Q91: Tomasini Corporation has provided the following data

Q192: Musich Corporation has an activity-based costing system

Q222: When reconciling variable costing and absorption costing

Q239: Dilly Farm Supply is located in a

Q262: Bernosky Corporation is conducting a time-driven activity-based

Q374: Mirabile Corporation uses activity-based costing to compute