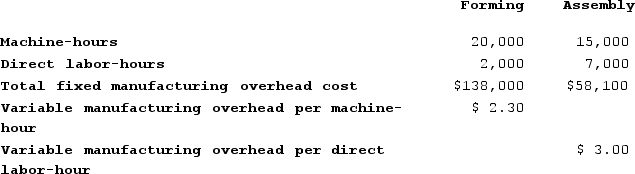

Stoke Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A460. The following data were recorded for this job:

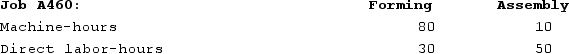

During the current month the company started and finished Job A460. The following data were recorded for this job: The amount of overhead applied in the Forming Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Forming Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Q33: At a sales volume of 38,000 units,

Q83: The following partially completed T-accounts are for

Q118: The Collins Corporation uses a job-order costing

Q175: Which of the following statements is not

Q227: Matthias Corporation has provided data concerning the

Q243: Mccaskell Corporation's relevant range of activity is

Q250: The following cost data pertain to the

Q269: Pebbles Corporation has two manufacturing departments--Casting and

Q310: Baka Corporation applies manufacturing overhead on the

Q345: Parido Corporation has two manufacturing departments--Casting and