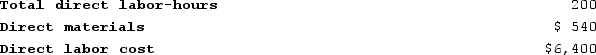

Obermeyer Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on 10,000 direct labor-hours, total fixed manufacturing overhead cost of $96,000, and a variable manufacturing overhead rate of $3.60 per direct labor-hour. Job A735, which was for 40 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:a. Calculate the amount of overhead applied to Job A735.b. Calculate the total job cost for Job A735.c. Calculate the unit product cost for Job A735.

Required:a. Calculate the amount of overhead applied to Job A735.b. Calculate the total job cost for Job A735.c. Calculate the unit product cost for Job A735.

Definitions:

Useful Life

The estimated duration of time a fixed asset is expected to be usable for its intended purpose.

Equipment

Equipment consists of the tools, machinery, and other durable assets used in the production of goods or services.

Intangible Benefits

Non-quantifiable advantages provided by goods or services, such as brand reputation or employee satisfaction.

Discount Rate

The rate used within discounted cash flow assessments to ascertain the present-day value of anticipated cash flows.

Q1: Bierce Corporation has two manufacturing departments--Machining and

Q5: Krier Corporation uses a predetermined overhead rate

Q13: Mahon Corporation has two production departments, Casting

Q24: The following partially completed T-accounts summarize transactions

Q27: Lupo Corporation uses a job-order costing system

Q62: Boursaw Corporation has provided the following data

Q207: Kostelnik Corporation uses a job-order costing system

Q266: Kalp Corporation has two production departments, Machining

Q278: Schwiesow Corporation has provided the following information:

Q399: Valvano Corporation uses a job-order costing system