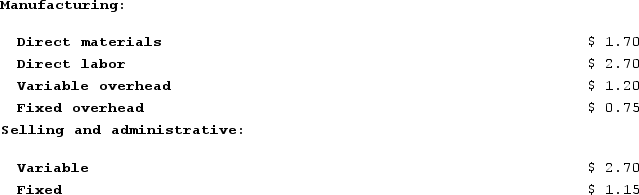

The following are Silver Corporation's unit costs of making and selling an item at a volume of 7,800 units per month (which represents the company's capacity) :  Present sales amount to 6,100 units per month. An order has been received from a customer in a foreign market for 1,700 units. The order would not affect regular sales. Total fixed costs, both manufacturing and selling and administrative, would not be affected by this order. The variable selling and administrative costs would have to be incurred for this special order as well as all other sales. Assume that direct labor is a variable cost.Assume the company has 85 units left over from last year which have small defects and which will have to be sold at a reduced price for scrap. The sale of these defective units will have no effect on the company's other sales. Which of the following costs is relevant in this decision?

Present sales amount to 6,100 units per month. An order has been received from a customer in a foreign market for 1,700 units. The order would not affect regular sales. Total fixed costs, both manufacturing and selling and administrative, would not be affected by this order. The variable selling and administrative costs would have to be incurred for this special order as well as all other sales. Assume that direct labor is a variable cost.Assume the company has 85 units left over from last year which have small defects and which will have to be sold at a reduced price for scrap. The sale of these defective units will have no effect on the company's other sales. Which of the following costs is relevant in this decision?

Definitions:

National Road

Also known as the Cumberland Road, it was the first major improved highway in the United States built by the federal government, stretching from Maryland to Illinois.

Public Land Sales

The process of selling land owned by the government to private individuals or entities, typically for residential, commercial, or agricultural development.

Panic Of 1819

The first widespread economic crisis in the United States, marked by bank failures, foreclosures, and severe unemployment, leading to significant shifts in economic policy.

Hard Currency

A currency that is widely accepted around the world as a form of payment and is known for its stability and reliability.

Q114: Prudencio Corporation has provided the following information

Q120: Bohmker Corporation is introducing a new product

Q124: A cost center is a responsibility center.

Q175: Hinger Corporation is considering a capital budgeting

Q225: Stockinger Corporation has provided the following information

Q260: Fabri Corporation is considering eliminating a department

Q264: Colantro Corporation has provided the following information

Q269: Benjamin Company produces products C, J, and

Q288: Mercer Corporation estimates that an investment of

Q375: Devon Corporation uses a discount rate of