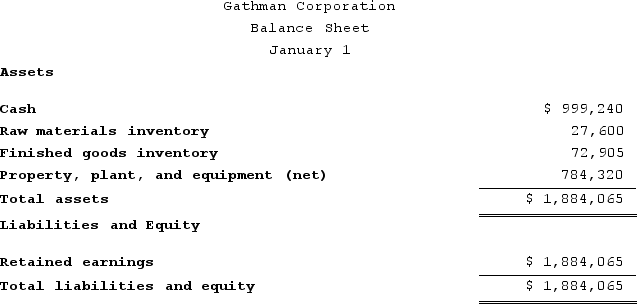

Gathman Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The company's balance sheet at the beginning of the year was as follows:

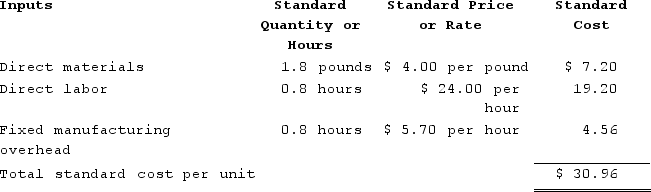

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $114,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $114,000 and budgeted activity of 20,000 hours.

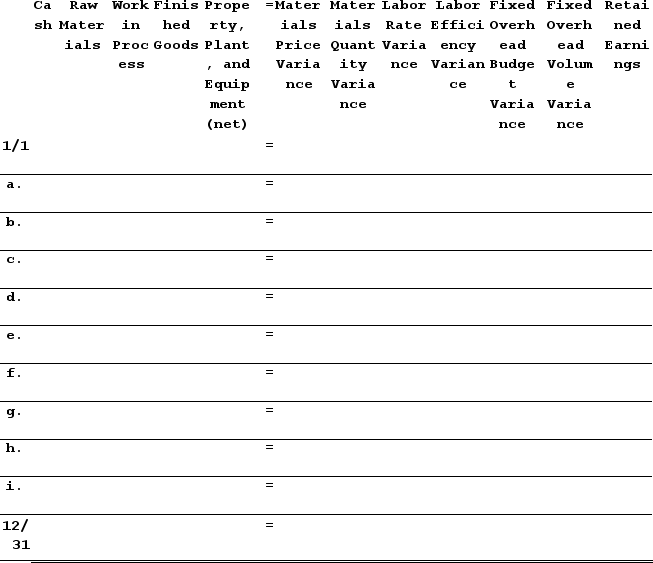

During the year, the company completed the following transactions:Purchased 31,300 pounds of raw material at a price of $3.70 per pound.Used 32,140 pounds of the raw material to produce 17,800 units of work in process.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,240 hours at an average cost of $23.00 per hour.Applied fixed overhead to the 17,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $133,100. Of this total, $28,270 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $104,830 related to depreciation of manufacturing equipment.Transferred 17,800 units from work in process to finished goods.Sold for cash 17,600 units to customers at a price of $62.00 per unit.Completed and transferred the standard cost associated with the 17,600 units sold from finished goods to cost of goods sold.Paid $73,360 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.Required:1. Compute all direct materials, direct labor, and fixed overhead variances for the year.2. Enter the beginning balances and record the above transactions in the worksheet that appears below.

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

3. Determine the ending balance (e.g., 12/31 balance) in each account.4. Prepare an income statement for the year.

Definitions:

Underground Railroad

Operating in the decades before the Civil War, a clandestine system of routes and safehouses through which slaves were led to freedom in the North.

Disenfranchisement

Depriving a person or persons of the right to vote; in the United States, exclusionary policies were used to deny groups, especially African-Americans and women, their voting rights.

Constitutional Provisions

Constitutional provisions are specific articles, clauses, and amendments in a constitution that outline the framework and principles governing a country.

Q4: A clinic nurse is performing venipuncture on

Q13: Ashley transfers property with a tax basis

Q25: A nurse is assessing an older adult

Q31: Kartman Corporation makes a product with the

Q34: Which of the following rationales for adjusting

Q42: Tax elections are rarely made at the

Q55: Milar Corporation makes a product with the

Q65: Mirabito Incorporated has provided the following data

Q87: Phillip incorporated his sole proprietorship by transferring

Q275: Creaser Products, Incorporated, has a Sensor Division