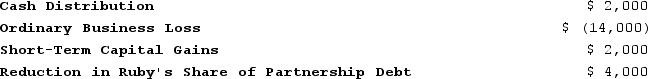

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Definitions:

Lower Taxes

The reduction of tax rates or tax burdens to encourage economic activities or provide relief to taxpayers.

Increased Government Spending

A fiscal policy where the government expands its expenditures to stimulate economic growth or address public needs.

Annual Budget

A financial document forecasted for a year that outlines expected income and expenditure for an organization or government.

Government Funds

Financial resources allocated by the government for specific purposes, often aimed at public projects or to aid sectors of the economy.

Q1: J&J, LLC, was in its third year

Q3: Upon inspection of a client's peripheral I.V.

Q3: A nurse is preparing to begin fluid

Q13: Which of the following items is not

Q15: A nurse is preparing to administer a

Q46: Ruby's tax basis in her partnership interest

Q80: On March 15, 20X9, Troy, Peter, and

Q163: Stallbaumer Incorporated makes a single product--an electrical

Q170: Alberts Corporation manufactures one product. It does

Q310: Moozi Dairy Products processes and sells two