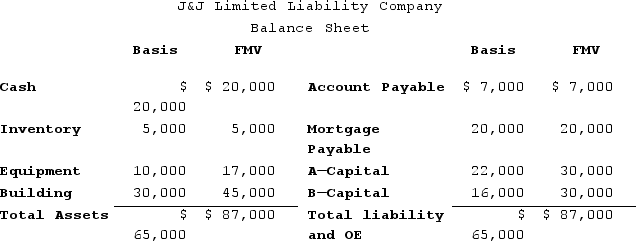

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Cardiac Death

Occurs when the heart stops beating as a result of heart failure or other cardiovascular conditions, leading to a loss of blood flow throughout the body.

Easygoing Attitude

A type of personality trait that is characterized by being relaxed, amiable, and free from stress or worry.

Laid-back

Having a relaxed or casual manner; not overly stressed or anxious.

Type B

Refers to a personality type characterized by lower stress levels, a relaxed attitude, and a patient demeanor, in contrast to Type A personalities.

Q1: Flick Company uses a standard cost system

Q4: A nurse is preparing to initiate an

Q8: A client with pancreatitis has an order

Q9: Camps Incorporated has a standard cost system.

Q12: Which of the following statements is true?<br>A)

Q19: A nurse assesses a client who has

Q72: Comet Company is owned equally by Pat

Q78: Tax-exempt interest from municipal bonds is an

Q105: In X1, Adam and Jason formed ABC,

Q276: Jakeman Corporation manufactures one product. It does