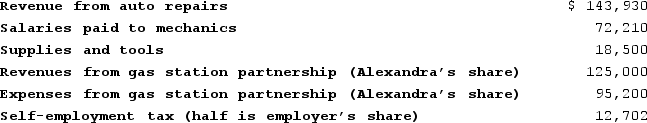

Alexandra operates a garage as a sole proprietorship. Alexandra also owns a half interest in a partnership that operates a gas station. This year Alexandra paid or reported the following expenses related to her garage and other property. Determine Alexandra's AGI for 2020.

Definitions:

Herfindahl-Hirschman Index

A measure of market concentration used to evaluate potential antitrust concerns, calculated by squaring the market share of each firm competing in the market and then summing the resulting numbers.

Industry

The collection of businesses and activities involved in the manufacturing, production, or provision of goods and services in a particular sector.

Firm(s)

Businesses or corporations established to perform economic activities, such as producing goods or offering services to consumers.

Dango

A Japanese term referring to informal gatherings or consortia where companies collude, often used in the context of bid-rigging.

Q3: Todd operates a business using the cash

Q8: This year Latrell made the following charitable

Q63: Fran purchased an annuity that provides $13,800

Q86: Unrecaptured §1250 gain is taxed at the

Q88: Ben received the following benefits from his

Q89: The deduction for business interest expense is

Q90: Fran purchased an annuity that provides $12,000

Q108: Which of the following statements regarding exclusions

Q114: Harmony reports a regular tax liability of

Q115: Alexandra operates a garage as a sole