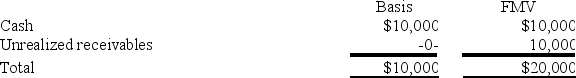

The PW partnership's balance sheet includes the following assets immediately before it liquidates:

In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners) . Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Wade's recognized gain or loss?

Definitions:

Tariff

A tax imposed by a government on goods and services imported from other countries to protect domestic industries from foreign competition.

Restrictions

Limitations or constraints imposed on activities, actions, or movements, often by laws, regulations, or policies.

Government Revenue

The income received by the government from taxes, fees, fines, and other sources.

Tariff

A tax imposed by a government on goods and services imported from other countries to protect domestic industries.

Q38: ABC was formed as a calendar-year S

Q47: Once determined, an unrecognized tax benefit under

Q47: Nadine Fimple is a one-half partner in

Q60: Use tax liability accrues in the state

Q75: Sybil transfers property with a tax basis

Q75: A distribution from a corporation to a

Q84: Partners adjust their outside basis by adding

Q91: Which of the following book-tax basis differences

Q94: Identify the following items as creating a

Q116: Matthew and Addison are married and live