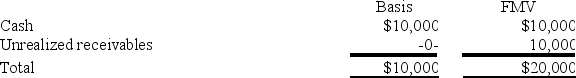

The PW partnership's balance sheet includes the following assets immediately before it liquidates:

In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners) . Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Wade's recognized gain or loss?

Definitions:

Invasion of Privacy

The infringement upon the personal space or information of an individual without consent, which can lead to legal action.

Unreasonable Intrusion

An invasive act that violates an individual's reasonable expectation of privacy and is not legally justifiable.

False Light

A privacy tort involving a misleading portrayal of an individual that is highly offensive or embarrassing, even if not defamatory.

Drug and Alcohol Testing

The process of checking an individual's body fluids or breath for the presence of drugs or alcohol, commonly used in employment and legal settings.

Q3: The Canadian government imposes a withholding tax

Q8: Heron Corporation reported pretax book income of

Q19: Personal selling and sales promotion are both

Q44: Which of the following does not adjust

Q51: The requirements for tax deferral in a

Q66: The Federal transfer taxes are calculated using

Q70: A state's apportionment formula divides nonbusiness income

Q79: The SSC Partnership balance sheet includes the

Q84: Which of the following businesses is likely

Q101: Illuminating Light Partnership had the following revenues,