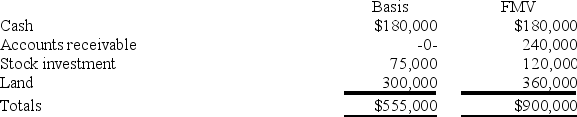

Katrina is a one-third partner in the KYR partnership (calendar year-end). Katrina decides she wants to exit the partnership and receives a proportionate distribution to liquidate her partnership interest on January 1. The partnership has no liabilities and holds the following assets as of January 1:

Katrina receives one-third of each of the partnership assets. She has a basis in her partnership interest of $110,000. What is the amount and character of any recognized gain or loss to Katrina? What is Katrina's basis in the distributed assets?

Definitions:

Traumatic Life Experiences

Events or situations that cause severe psychological distress, potentially leading to long-term emotional and mental health issues, including post-traumatic stress disorder (PTSD).

Collaborative Communication

A healthcare approach that emphasizes open, honest communication and teamwork among all members of the healthcare team, including the patient, to improve outcomes and satisfaction.

Joint Commission

An independent, not-for-profit organization that accredits and certifies healthcare organizations and programs in the United States.

Outcome

The result or effect of an action, situation, or event, often used to assess the effectiveness of medical treatments.

Q6: Which of the following statements regarding the

Q22: The executor of Isabella's estate incurred administration

Q23: Packard Corporation reported taxable income of $1,000,000

Q36: Under general circumstances, debt is allocated from

Q52: Public Law 86-272 protects solicitation from income

Q54: A salesperson who follows the trust-based relationship

Q88: Which of the following items does not

Q101: Illuminating Light Partnership had the following revenues,

Q117: Property inherited from a decedent has an

Q120: The marital and charitable deductions are common