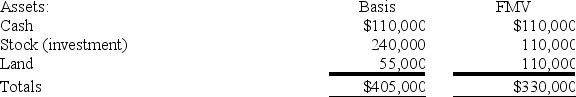

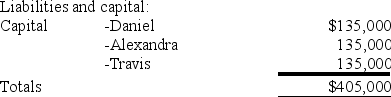

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Diaphragm

A muscular and membranous partition separating the abdominal and thoracic cavities and plays a major role in breathing.

Dead Space

Areas in the respiratory system that do not participate in gas exchange, including the nasal cavities, trachea, and bronchi.

Lung Compliance

Lung compliance refers to the ease with which the lungs can be expanded, determined by the elastic resistance of the lung tissue and chest wall to stretching during inhalation.

Inspiratory Reserve Volume

The additional amount of air that can be inhaled after a normal inhalation, contributing to lung capacity.

Q10: Which of the following statements best describes

Q19: Personal selling and sales promotion are both

Q39: Sophia is single and owns the following

Q45: Oakland Corporation reported a net operating loss

Q49: Inez transfers property with a tax basis

Q64: Businesses must pay income tax in their

Q65: Martha is a 40% partner in the

Q67: Under the book value method of allocating

Q70: A partner will recognize a loss from

Q73: XYZ Corporation (an S corporation) is owned