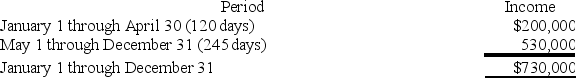

ABC was formed as a calendar-year S corporation with Alan, Brenda and Conner as equal shareholders. On May 1, 2018, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares) to his solely owned C corporation Conner, Inc. ABC reported business income for 2018 as follows (assume that there are 365 days in the year):

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

Definitions:

Yield To Maturity

The total return anticipated on a bond if the bond is held until it matures.

Semi-Annually

Occurring twice a year, typically used in finance to describe payment intervals or adjustments.

Face Value

The nominal or dollar value printed on a bond, note, or other financial instrument, indicating its worth at maturity.

Treasury Bond

A long-term government bond issued by the U.S. Treasury with a maturity period typically ranging from 20 to 30 years.

Q8: Which of the following statements is true

Q10: A salesperson can deal with the issue

Q15: It is necessary for order-takers to use

Q26: Corporations taxed as S corporations offer the

Q32: Madison Corporation reported taxable income of $400,000

Q38: Sunapee Corporation reported taxable income of $700,000

Q53: The estate tax is imposed on testamentary

Q68: Frank and Bob are equal members in

Q73: Jasmine transferred 100 percent of her stock

Q90: Which of the following statements regarding disproportionate