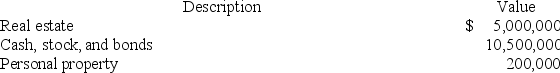

At his death in 2018, Nathan owned the following property:

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1)

Definitions:

Feelings and Beliefs

Emotional and cognitive components that influence an individual's perception of the world, guiding their attitudes, decisions, and actions.

Severity

The intensity, seriousness, or degree of something, often used in reference to symptoms, conditions, or situations.

Seriousness

The state or quality of being serious, solemn, or earnest.

Client Satisfaction Questionnaires

Tools used to gather feedback from clients on their perceptions of the quality and effectiveness of services received.

Q2: Most states have shifted away from an

Q2: The _ method refers to a response

Q19: Which of the following is not a

Q29: Which the following is a characteristic of

Q31: Which of the following is true of

Q36: The gift-splitting election only applies to gifts

Q42: Gordon operates the Tennis Pro Shop in

Q48: The estate and gift taxes share several

Q58: S corporations generally recognize gain or loss

Q72: Lamont is a 100% owner of JKL