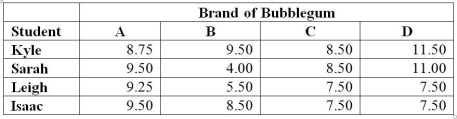

TABLE 11-7

A student team in a business statistics course designed an experiment to investigate whether the brand of bubblegum used affected the size of bubbles they could blow. To reduce the person-to-person variability, the students decided to use a randomized block design using themselves as blocks. Four brands of bubblegum were tested. A student chewed two pieces of a brand of gum and then blew a bubble, attempting to make it as big as possible. Another student measured the diameter of the bubble at its biggest point. The following table gives the diameters of the bubbles (in inches) for the 16 observations.

-Referring to Table 11-7, the relative efficiency means that 1.0144 times as many observations in each brand would be needed in a one-way ANOVA design as compared to the randomized block design in order to obtain the same precision for comparison of the different means.

Definitions:

Futures Exchange

A Futures Exchange is a central marketplace where people can trade standardized futures contracts; that is, contracts to buy or sell assets at a future date at an agreed-upon price.

Interest Rate Swap

A financial derivative contract where two parties exchange interest rate payments, typically one with a fixed rate and the other with a floating rate.

Futures Put Option

A financial contract giving the buyer the right, but not the obligation, to sell a futures contract at a specified price within a specified time.

Sale Price

Sale price refers to the final price at which a product or service is sold after any discounts or promotions are applied.

Q9: Referring to Table 13-9, the p-value of

Q12: Referring to Table 12-6, what is the

Q78: Referring to Table 10-2, the researcher was

Q92: Referring to Table 11-3, the null hypothesis

Q94: Referring to Table 12-15, what should be

Q129: Referring to Table 12-16, which is the

Q142: Referring to Table 12-19, the sporting goods

Q154: Referring to Table 10-1, judging from the

Q172: Referring to Table 12-5, what is the

Q195: Referring to Table 12-8, at 5% level