The following information relates to Questions 20-27John Smith, an investment adviser, meets with lydia Carter to discuss her pending retirement

and potential changes to her investment portfolio. domestic economic activity has been weak-ening recently, and Smith's outlook is that equity market values will be lower during the next year. He would like Carter to consider reducing her equity exposure in favor of adding more fixed-income securities to the portfolio.Government yields have remained low for an extended period, and Smith suggests con-sidering investment-grade corporate bonds to provide additional yield above government debt issues. in light of recent poor employment figures and two consecutive quarters of negative GdP growth, the consensus forecast among economists is that the central bank, at its next meeting this month, will take actions that will lead to lower interest rates.

Smith and Carter review par, spot, and one-year forward rates (Exhibit 1) and four fixed- rate investment-grade bonds issued by Alpha Corporation that are being considered for invest-ment (Exhibit 2) .

EXHIBIT 2 Selected Fixed-Rate Bonds of Alpha Corporation

Note: All bonds in Exhibit 2 have remaining maturities of exactly three years.

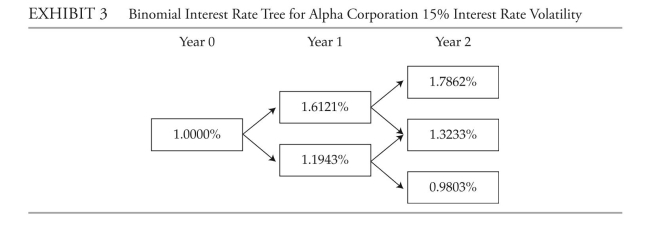

Carter tells Smith that the local news media have been reporting that housing starts,exports, and demand for consumer credit are all relatively strong, even in light of other poor macroeconomic indicators. Smith explains that the divergence in economic data leads him to believe that volatility in interest rates will increase. Smith also states that he recently read a report issued by Brown and Company forecasting that the yield curve could invert within the next six months. Smith develops a binomial interest rate tree with a 15% interest rate volatility assumption to assess the value of Alpha Corporation's bonds. Exhibit 3 presents the interest rate tree.

Carter asks Smith about the possibility of nalyzing bonds that have lower credit rat-ings than the investment-grade Alpha bonds. Smith discusses four other corporate bonds with Carter. Exhibit 4 presents selected data on the four bonds. EXHiBiT 4 Selected information on fixed-Rate Bonds for Beta, Gamma, delta, and Rho

Notes: All bonds have remaining maturities of three years. oAS stands for option-adjusted spread.

-Based on Exhibit 2, and assuming that the forecast for interest rates and Smith's outlook for equity returns are validated, which bond's option is most likely to be exercised?

Definitions:

Filtration Membrane

A selectively permeable barrier that separates substances in a mixture based on size or other characteristics, widely used in biological and chemical processes.

Renal Blood Flow

The amount of blood that passes through the kidneys per unit of time, crucial for filtering waste from the blood and adjusting blood pressure.

Clearance Calculation

A method used to determine the rate at which a substance is removed from the body by the kidneys, indicating kidney function and efficiency.

Hematocrit

The proportion of blood volume that is occupied by red blood cells, expressed as a percentage.

Q2: Find the center and vertices of

Q3: an investor purchases an annual coupon bond

Q8: y-direction force on frame ABCDEF below

Q18: Find an equation of the tangent

Q24: Consider the following function. <span

Q28: Evaluate the following expression. <span

Q31: if the market price of Pro Star's

Q36: The volume of a right circular

Q48: Determine whether the function is even,

Q62: Which of the given functions is discontinuous?