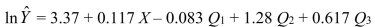

SCENARIO 16-14 A contractor developed a multiplicative time-series model to forecast the number of contracts in future quarters, using quarterly data on number of contracts during the 3-year period from 2011 to 2013.The following is the resulting regression equation:  where

where  is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.

is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2011.  is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q

is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise. Q  is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.  is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

-Referring to Scenario 16-14, the best interpretation of the coefficient of Q  (0.617) in the regression equation is:

(0.617) in the regression equation is:

Definitions:

Grieving

The emotional process of coping with loss, which can involve feelings of sadness, anger, guilt, and denial.

Spouses

Legally married partners or significant others in a committed relationship.

Prevalent Pattern

Describes a common or widespread trend, habit, or form that can be observed across various contexts or environments.

Ambiguous Loss

A type of loss that is unclear and lacks a clear resolution or closure.

Q5: The director of admissions at a state

Q34: Referring to Scenario 18-8, the alternative hypothesis

Q39: Ward's minimum variance can be used to

Q70: The following two statements are equivalent in

Q76: As a project for his business statistics

Q89: Referring to Scenario 16-4, construct a centered

Q140: Referring to Scenario 14-15, the null hypothesis

Q229: A regression had the following results: SST

Q286: Referring to Scenario 18-10 Model 1, estimate

Q301: Referring to Scenario 14-7, the predicted GPA