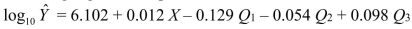

SCENARIO 16-12 A local store developed a multiplicative time-series model to forecast its revenues in future quarters, using quarterly data on its revenues during the 5-year period from 2009 to 2013.The following is the resulting regression equation:  where

where  is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2008.

is the estimated number of contracts in a quarter. X is the coded quarterly value with X = 0 in the first quarter of 2008.  is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise.  is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise.  is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise.

-Referring to Scenario 16-12, the best interpretation of the coefficient of  (0.098) in the regression equation is:

(0.098) in the regression equation is:

Definitions:

Provincial Agency

A government organization or entity that operates at a provincial level, responsible for administering specific services or regulatory functions.

Issuance and Trading

Refers to the process of issuing new securities, like stocks or bonds, and their subsequent buying and selling on markets.

Prospectus

A legal document issued by companies that are offering securities for sale, containing details about the investment offering and the company's financial status.

Corporation End

The legal dissolution or termination of the existence of a corporation.

Q2: Referring to Scenario 14-5, at the 0.01

Q20: Referring to Scenario 15-4, the quadratic effect

Q27: Referring to Scenario 15-3, suppose the chemist

Q33: Referring to Scenario 15-1, what is the

Q70: Collinearity is present when there is a

Q126: Referring to Scenario 14-19, what is the

Q128: Referring to Scenario 14-19, what is the

Q240: Referring to Scenario 14-5, what is the

Q290: A certain type of new business succeeds

Q298: Referring to Scenario 14-17, there is sufficient