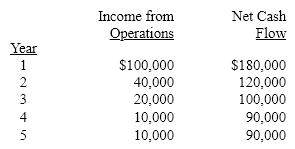

The management of Idaho Corporation is considering the purchase of a new machine costing $430,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability of this investment:  The net present value for this investment is

The net present value for this investment is

Definitions:

Q32: A quadratic model for the median price

Q57: Vanessa Company is evaluating a project requiring

Q78: Jamison Company produces and sells Product X

Q84: Factors that reflect the ability of a

Q101: Solvency analysis focuses on the ability of

Q111: Horizontal analysis of comparative financial statements includes<br>A)

Q113: Lead time includes both value-added time and

Q132: Preferred stock issued in exchange for land

Q137: Stryker Industries received an offer from an

Q160: The costs of initially producing an intermediate