Use This Information to Answer the Following Questions -Use the Sensitivity Report to Answer the Following Questions:

A

Use this information to answer the following questions.

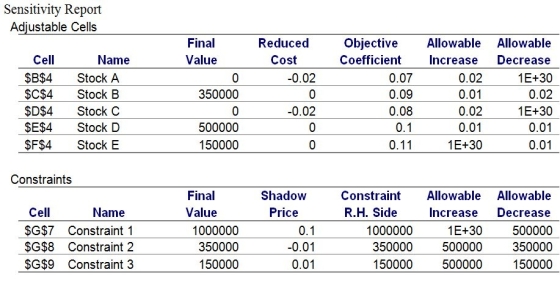

An investment company currently has $1 million available for investment in five different stocks.The company wants to maximize the interest earned over the next year.The five investment possibilities along with the expected interest earned are shown below.To manage risk,the investment firm wishes to have at least 35% of the investment in stocks A and B.Furthermore,no more than 15% of the investment may be in stock E.

-Use the Sensitivity Report to answer the following questions:

a.Suppose that the amount of money available for investment increases by $50,000.What impact would this have on the current optimal objective function value?

b.Suppose that total investment in stocks A and B must be at least 40% of the total amount available for investment (i.e. ,$400,000).What impact would this have on the current optimal objective function value?

c.Suppose that the total investment in stocks A and be must be at least 30% of the total amount available for investment.What impact would this have on the current optimal objective function value?

d.Assume that no more than 30% of the investment may be in stock E.What impact would this have on the current optimal objective function value?

Definitions:

Sexual Harassment

Unwelcome sexual advances, requests for sexual favors, or other verbal or physical harassment of a sexual nature.

Exercise

Physical activities undertaken to maintain or improve health and fitness.

Young Adults

Individuals in the age group that follows adolescence, typically ranging from 18 to 25 years old, characterized by further development of personal and economic independence.

Stress

A physical or psychological response to internal or external pressures, resulting in mental and physical symptoms ranging from discomfort to severe health issues.

Q3: Use the Sensitivity Report to answer the

Q7: The objective function of the "Diet" problem

Q11: Sensitivity analysis is analogous to postoptimality analysis

Q12: A service system has a constant service

Q15: According to reinforcement theory, extinction refers to

Q15: Refer to Scenario 14.1.The human resource department

Q16: If all the variables in a model

Q31: Crystal Ball's CB.Custom function can be used

Q45: Which of the following is a prerequisite

Q48: Deviational variables assume the value zero if