Use This Information to Answer the Following Questions -Use the Sensitivity Report to Answer the Following Questions:

A

Use this information to answer the following questions.

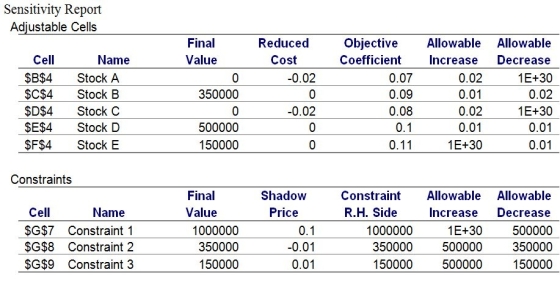

An investment company currently has $1 million available for investment in five different stocks.The company wants to maximize the interest earned over the next year.The five investment possibilities along with the expected interest earned are shown below.To manage risk,the investment firm wishes to have at least 35% of the investment in stocks A and B.Furthermore,no more than 15% of the investment may be in stock E.

-Use the Sensitivity Report to answer the following questions:

a.What would be the impact on the optimal allocation if the expected interest earned on stock A decreases to 6%?

b.What would be the impact on the optimal allocation if the expected interest earned on stock A increases to 10%?

c.What should the minimal expected interest earned for stock C be before it would be desirable to invest in this particular stock?

d.What would be the impact on the optimal allocation and the objective function value if the expected interest earned on stock B decreases by 1%?

Definitions:

NAACP

The National Association for the Advancement of Colored People, a civil rights organization in the United States formed in 1909 to fight against racial discrimination.

Electoral Politics

The branch of politics that deals with elections and voting as a means for the electorate to select candidates to hold public office.

Racial Inequality

The unequal treatment or perceptions of individuals based on their race, leading to disparities in wealth, healthcare, education, and employment among other sectors.

Grandfather Clauses

Provisions that allowed individuals to bypass literacy tests, poll taxes, or other barriers to voting if their grandfathers had been eligible to vote, effectively disenfranchising many African Americans.

Q2: Organizations can be fined for major violations

Q3: Refer to Figure 1.What cell reference designates

Q7: Which of the following methods is most

Q10: Explain the contemporary perspective on workforce diversity

Q16: A slowdown occurs when an employer denies

Q23: Early research determining that individual and group

Q29: When using Solver,the parameter Changing Cells is

Q42: The_ theory suggests that organizations can best

Q45: The approach that is used for analyzing

Q45: Which of the following is a prerequisite