Use This Information to Answer the Following Questions -Use the Sensitivity Report to Answer the Following Questions:

A

Use this information to answer the following questions.

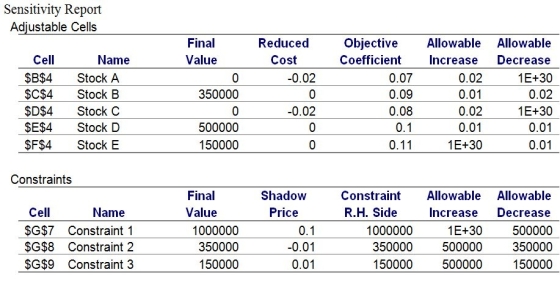

An investment company currently has $1 million available for investment in five different stocks.The company wants to maximize the interest earned over the next year.The five investment possibilities along with the expected interest earned are shown below.To manage risk,the investment firm wishes to have at least 35% of the investment in stocks A and B.Furthermore,no more than 15% of the investment may be in stock E.

-Use the Sensitivity Report to answer the following questions:

a.Suppose that the amount of money available for investment increases by $50,000.What impact would this have on the current optimal objective function value?

b.Suppose that total investment in stocks A and B must be at least 40% of the total amount available for investment (i.e. ,$400,000).What impact would this have on the current optimal objective function value?

c.Suppose that the total investment in stocks A and be must be at least 30% of the total amount available for investment.What impact would this have on the current optimal objective function value?

d.Assume that no more than 30% of the investment may be in stock E.What impact would this have on the current optimal objective function value?

Definitions:

Turnitin.com

An Internet-based plagiarism detection service used by educational institutions to check the originality of students' work.

Creative Commons

A non-profit organization that offers free licenses enabling creators to legally share their work with specified conditions.

Irrevocable

Something that cannot be changed, reversed, or recovered.

Intellectual Property

Refers to products derived from the mind, such as works of art and literature, inventions, and software code.

Q4: _ include all individuals who gain knowledge

Q11: Alpha-Beta Company closed a plant and laid

Q20: The optimal Economic Production Quantity (EPQ)minimizes the

Q27: The systems flexibility argument for diversitysuggests that

Q30: A human resource management system integrates which

Q32: Alternate optimal solutions are not common in

Q41: Refer to the table above.<br>a.Use a 3-period

Q48: Deviational variables assume the value zero if

Q48: _ items are included in the collective-bargaining

Q50: Managing diversity in an organization starts with:<br>A)