Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

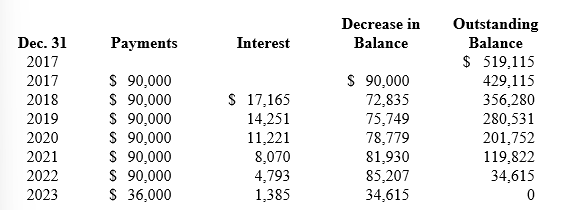

Reagan's lease amortization schedule appears below:

-At what amount would Reagan record the right-of-use asset at the beginning of the agreement?

Definitions:

School District

An organizational entity within a specific geographical area that operates and manages public schools.

Average Distance

A measure used to calculate the mean distance between points in a dataset, often used in logistics and planning.

Distribution Centre

A warehouse or storage facility where goods are kept until they are distributed to retailers or customers.

Q17: Fair value option<br>A) Gain or loss reported

Q33: Indicate why LMC lists net operating loss

Q52: Straight-line amortization of bond discount or premium:<br>A)

Q54: At the end of the prior year,

Q60: Amortizing prior service cost for pension plans

Q101: If the lessee is expected to take

Q105: Why do companies find the issuance of

Q124: Deferred tax asset<br>A)Is usually a revenue or

Q134: Two independent situations are described below. Each

Q166: Conceptually, the service method provides a better