Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

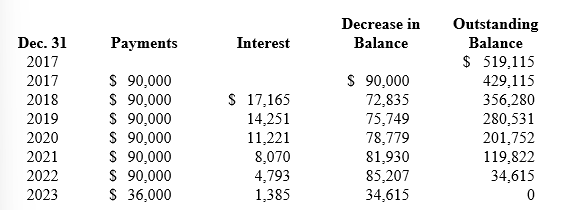

Reagan's lease amortization schedule appears below:

-What is the amount of residual value guaranteed by Reagan to the lessor?

Definitions:

Goodwill

An asset lacking physical substance that comes into existence when a firm is bought for an amount that surpasses the fair value of its recognizable net assets.

Cash-Flow Contingency

A provision or reserve for potential changes in cash flow due to uncertain future events that might affect a company's financial health.

Market-Price Contingency

A condition in a contract that the transaction's completion or the specifics of the transaction terms depend on future market prices.

Consolidated Balance Sheet

A financial statement that aggregates the assets, liabilities, and equity of a parent company and its subsidiaries into one document for a clear view of the total business.

Q10: Persoff Industries International has a defined benefit

Q52: Mann Co. is the lessee in a

Q65: Four independent situations are described below. Each

Q91: Determine the price of a $200,000 bond

Q134: Top Foods has an underfunded pension plan.

Q154: Will LMC report $819.9 million as a

Q166: Identify three examples of permanent differences between

Q211: Omega leased a machine for a ten-year

Q223: Mars Inc. has a defined benefit pension

Q258: On January 1, 2018, Burrito Bill's leased