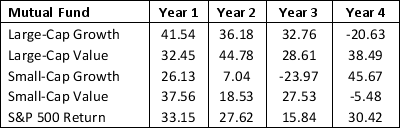

Consider the data on investment made in four types of funds and returns from S&P 500.

a. Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. (Hint: Minimize the sum of the squared deviations between the portfolio's return and the S&P 500 Index return for each year in the data set.)

a. Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. (Hint: Minimize the sum of the squared deviations between the portfolio's return and the S&P 500 Index return for each year in the data set.)

b. Solve the model developed in part a.

Definitions:

In-Ground Swimming Pool

A permanent pool constructed in the ground, often made of concrete, fiberglass, or vinyl, offering leisure and recreation.

Follow-Up

Phase of production control in which employees and their supervisors spot problems in the production process and determine needed adjustments.

Installation

The process of setting up a piece of equipment or software to be ready for use.

Virtual Approach

A strategy that involves using digital technologies and the internet to conduct business activities, largely reducing or eliminating the need for physical presence.

Q2: The physician has started a patient on

Q2: Which of the following terms refers to

Q4: In a nonlinear problem, the rate of

Q5: Lidocaine may be used for treating dysrhythmias

Q6: _ is an Excel tool that utilizes

Q10: Many drugs have names that sound or

Q12: Sansuit Investments is deciding on future investment

Q17: Greentrop Pharmaceutical Products are the world leader

Q24: What would be the mean square error

Q39: What would be the value added by