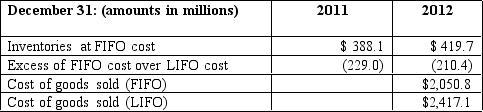

A large manufacturer recently changed its cost-flow assumption method for inventories at the beginning of 2012.The manufacturer has been in operation for almost 40 years,and for the last decade,it has reported moderate growth in revenues.The firm changed from the LIFO method to the FIFO method and reported the following information:

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Definitions:

Factory Machine Hours

A measure of production time, indicating the total hours that machinery is operated in the manufacturing process.

Power Costs

The expenses incurred by a company for the electricity or energy used in its operations.

Sales Price

The amount of money for which a product or service is sold to the customer.

Contribution Margin

The amount by which sales revenue exceeds variable costs, contributing to covering fixed costs and profit generation.

Q2: Marker's 2012 Long-term Debt to Shareholders' Equity

Q9: Explain residual income.What does residual income represent?

Q16: What criteria should be used in deciding

Q20: Which of the following is not a

Q23: All of the following are examples of

Q27: The first step in the forecasting game

Q34: If Parnell Industries is certain that it

Q37: Explain why analysts and investors use risk-adjusted

Q56: If Parnell Industries is uncertain that it

Q112: Under a barter system<br>A) each good has