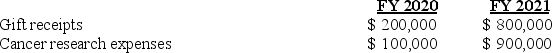

During the years ended June 30, 2020 and 2021, Jackson University, a private university, conducted a cancer research project financed by a $1,000,000 gift from an alumnus. The entire amount was pledged by the donor on July 10, 2019. The gift was restricted to the financing of this particular research project. During the two-year research period, Jackson's gift receipts from the alumnus and research expenses related to the research project were as follows for each fiscal year (FY) :

What amount of net assets was released from restriction in 2020?

Definitions:

Classify

The process of organizing or categorizing items, events, or transactions based on common characteristics or rules.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board that guide how company transactions and other events need to be reported in financial statements.

Revaluation

The process of adjusting the book value of an asset to reflect its current market value.

Intangible Assets

Assets that cannot be physically touched or seen but hold value, such as copyrights, trademarks, and patents.

Q27: According to the textbook, a focus group

Q29: Which of the following is one of

Q30: Which of the following is an example

Q32: Which of the following is the correct

Q43: Unrelated business income tax is reported on

Q55: Which of the following statements is incorrect

Q66: The primary opportunity existing for startups in

Q68: Firms that pursue a _ strategy compete

Q74: Amy has just launched a firm in

Q74: Hulu.com allows people to watch television shows