Exhibit 3.5

The following questions are based on this problem and accompanying Excel windows.

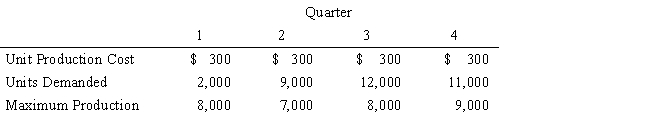

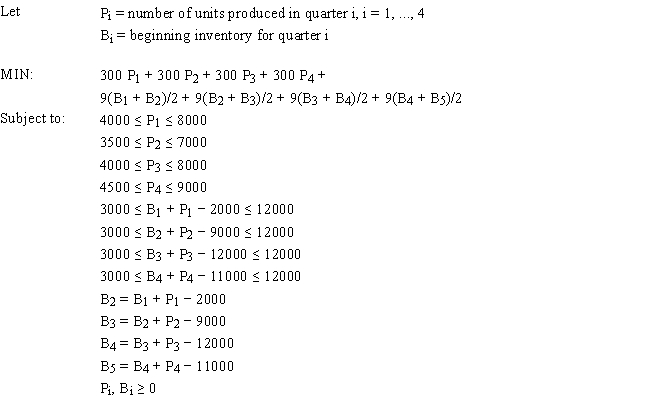

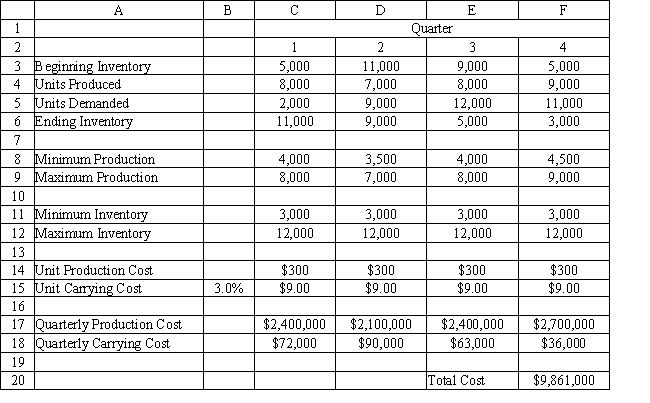

A company is planning production for the next 4 quarters. They want to minimize the cost of production. The production cost is stable but demand and production capacity vary from quarter to quarter. The maximum amount of inventory which can be held is 12,000 units and management wants to keep at least 3,000 units on hand. Quarterly inventory holding cost is 3% of the cost of production. The company estimates the number of units carried in inventory each month by averaging the beginning and ending inventory for each month. There are currently 5,000 units in inventory. The company wants to produce at no less than one half of its maximum capacity in any quarter.

-Refer to Exhibit 3.5. What formula should be entered in cell C18 in the accompanying Excel spreadsheet to compute the quarterly carrying costs?

Definitions:

Diagnostic Criteria

Standardized guidelines and conditions used by healthcare professionals to diagnose diseases and disorders.

DSM-5

The Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition, a handbook used by healthcare professionals as the authoritative guide to diagnosing mental disorders.

Appraisal of Reality

The process of assessing and understanding one's environment and experiences to distinguish between what is real and what may be influenced by internal perceptions.

Control Over Behavior

The ability of an individual to regulate and manage their actions in response to their thoughts, feelings, and environmental stimuli.

Q3: Refer to Exhibit 10.1. Suppose that for

Q3: In which of the following categories of

Q25: A hospital needs to determine how many

Q33: The ultimate goal of the problem identification

Q42: In a decision-making problem, anchoring effects occur

Q44: Which of the following categories of modeling

Q67: Refer to Exhibit 8.2. The company wishes

Q68: An office supply company is attempting to

Q121: Most college professors are granted tenure after

Q233: Suppose Nara could invest her $1000 in