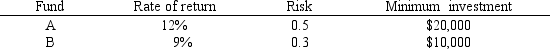

An investor wants to invest $50,000 in two mutual funds, A and B. The rates of return, risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment. The investor wants to maximize the expected rate of return while minimizing his risk. Any money beyond the minimum investment requirements can be invested in either fund. The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

Note that a low Risk rating means a less risky investment. The investor wants to maximize the expected rate of return while minimizing his risk. Any money beyond the minimum investment requirements can be invested in either fund. The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

Formulate a goal programming model with a MINIMAX objective function.

Definitions:

Coke and Pepsi

Refers to a classic example of duopoly in economics, representing competition between two dominant firms in a market.

Perfect Complementarity

Refers to a situation in consumer choice theory where two goods are always consumed together in fixed proportions because one is perfectly complementary to the other.

Engel Curve

A graph showing the relationship between the income of a consumer and the amount of a good that the consumer buys, illustrating how spending on a good varies with income.

Left and Right Shoes

Items that are perfect complements in consumption, where the use of one without the other is generally considered incomplete or unsatisfactory.

Q2: Which of the following is the

Q4: Retail companies try to find<br>A)the least costly

Q19: A company makes products A and B

Q34: The researcher would like to build a

Q37: Refer to Exhibit 9.1. Provide a rough

Q54: The regression residuals are computed as<br>A) <img

Q60: A network flow problem that allows gains

Q66: A company is developing its weekly

Q70: The _ in a decision problem represent

Q74: A store is considering adding a second