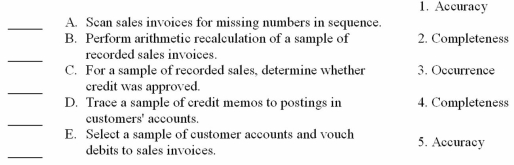

For each of the tests of controls for sales and receivables,indicate the assertion that is supported by placing the correct letter in the blank.

Definitions:

Pre-Tax Cost of Debt

The interest rate a company pays on its borrowings before taking into account any tax deductions.

Zero-Coupon Bonds

Zero-coupon bonds are debt securities that are issued at a discount to their face value and don’t pay interest before maturity; instead, investors receive the face value at maturity.

Face Value

The nominal or dollar value printed on a bond, bill, or other financial instrument, representing the amount due at maturity.

After-Tax Cost of Debt

The interest rate on a company's debt after taking into consideration the tax deductibility of interest expenses.

Q7: Auditors are auditing the cash receipts for

Q18: Which ASB balance assertion is of the

Q19: A CPA learns that his client has

Q19: List,and briefly describe,the three factors that increase

Q20: The production planner determines what inventory is

Q37: An auditor most likely would inspect additions

Q45: Which of the following is not true

Q56: When an account receivable is considered uncollectible,the

Q87: The payroll department approves payroll hours prior

Q135: In regard to lipids,the term unsaturated refers