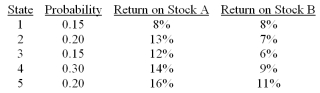

Consider the following probability distribution for stocks A and B:  The standard deviations of stocks A and B are _____ and _____, respectively.

The standard deviations of stocks A and B are _____ and _____, respectively.

Definitions:

Macroeconomic Policy

Strategies implemented by governments to influence the economy's overall performance by adjusting economic factors like interest rates, taxation, and public spending.

Monetary Policy

The setting of the money supply by policymakers in the central bank.

Fiscal Policy

The setting of the level of government spending and taxation by government policymakers

Stabilize The Economy

Government or central bank policies aimed at maintaining economic growth, curbing inflation, and reducing unemployment to prevent economic recessions or depressions.

Q1: Which of the following statements regarding the

Q2: Which of the following is not required

Q25: The securities act of 1933 I) requires

Q28: As diversification increases, the firm-specific risk of

Q35: A major finding by Heaton and Lucas

Q39: The holding-period return (HPR) on a share

Q40: Of the following types of ETFs, an

Q62: Consider the multifactor APT.The risk premiums on

Q69: Economists assume that rational people do all

Q78: Consider the single factor APT.Portfolios A and