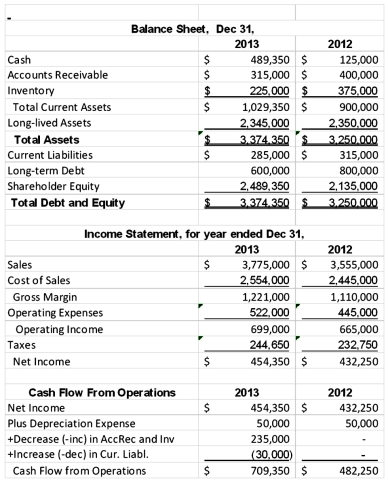

Jackson Manufacturing has the following operating results for 2013.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

In addition, the company paid dividends in both 2012 and 2013 of $100,000 per year and made capital expenditures in both years of $45,000 per year. The company's stock price in 2012 was $10 and $12 in 2013. The industry average earnings multiple for the industry was 10 in 2013 and the free cash flow and sales multiples were 20 and 2, respectively. The company is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2013. The industry average ratios for Jackson's industry were as follows in the most recent year.

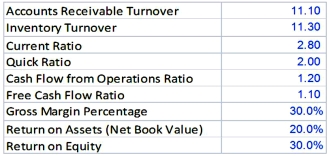

Exhibit A: Industry Ratios for the Jackson Company  Required:

Required:

1. Calculate the ratios In Exhibit A for Jackson Company for 2013, group them by category (liquidity, profitability) and develop a brief overview for the liquidity and profitability of the Jackson Company at the end of 2013.

2. Complete a Business Valuation for the Jackson Company based on 2013 financial statement information.

Definitions:

Milgram Experiment

A psychological experiment conducted by Stanley Milgram in the 1960s to study obedience to authority, where participants were instructed to administer electric shocks to another person.

Stanford University Prison Experiment

A psychological study conducted by Philip Zimbardo in 1971 at Stanford University, where students were assigned roles of prisoners and guards to explore the effects of perceived power.

Generalization

Drawing a conclusion about a certain characteristic of a population based on a sample from it.

Logical Support

The provision of reasons or evidence to justify a claim or argument.

Q6: Over the last few months, Ithaca Precision

Q9: Managers affect society directly with their decisions

Q22: People who are high on negative affectivity

Q26: The total productivity ratio in 2013 is:<br>A)0.20.<br>B)0.70.<br>C)1.00.<br>D)1.43.<br>E)5.00.

Q26: A significant problem in comparing profitability measures

Q49: Which of the following items is not

Q52: A method for determining a bonus based

Q83: Suppose you are an accountant for a

Q106: The theory of scientific management was introduced

Q128: The return on investment (ROI) for Division