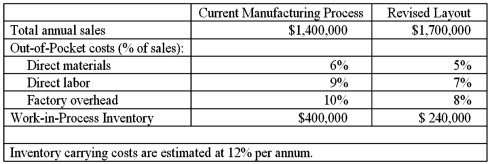

Turbo-Oven, Inc. is considering a move to cellular manufacturing. Management of the company has requested from you, as the management accountant, to supply it with information that will help inform the decision as to whether or not such a move is desirable. Your research into past performance of the company as well as extensive discussion with the manager of operations and the sales manager produced the following information.

Required:

Required:

1. In terms of the above information, provide for management of the company a rationale as to why you included each of the following items:

a. increase in total sales revenue

b. decrease in direct materials cost as a percentage of sales

c. decrease in holdings of Work-in-Process (WIP) inventory

2. Provide an estimate of each of the following financial effects associated with the proposed move to a cellular manufacturing layout:

a. change in total (out-of-pocket) manufacturing costs

b. reduction in WIP inventory holdings

c. net financial effect of the change, per year

3. In general, what types of costs would need to be incurred in order to reap the benefits outlined above in Requirement 2?

Definitions:

Q1: The direct labor efficiency variance in February

Q7: What were the total actual direct hours

Q13: The major operating divisions of Grey Company

Q13: Causes of random variances are beyond the

Q15: A deferred bonus can consist of:<br>A)Cash only.<br>B)Stock

Q17: The total variable cost flexible-budget variance includes

Q36: Home Products Inc has failed to reach

Q59: The fixed factory overhead production-volume variance represents:<br>A)Money

Q86: The biggest problem with cost-based transfer prices

Q125: What is the firm's market share variance?<br>A)$30,600