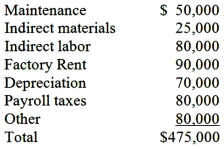

Ramirez Company uses a predetermined overhead rate. Overhead for the next twelve months is estimated to be $500,000. Ramirez applies overhead as a percentage of direct labor cost. Direct labor costs are estimated to be $625,000 for the next year. During the year actual direct labor costs amounted to $600,000 and the actual overhead was as follows:  Required:

Required:

(1) Calculate the over/under-applied overhead for the year.

(2) Prepare the journal entry to close the overhead accounts, assuming that the over/under-applied overhead is closed to cost of goods sold.

Definitions:

Restatement View

A perspective or doctrine derived from the Restatements of the Law, legal publications that seek to distill the common law into a series of principles or rules.

Tort Liability

Legal responsibility for damages caused by a wrongful act or omission other than breach of contract.

Accountant

A professional who performs financial functions related to the collection, accuracy, recording, analysis, and presentation of a business, organization, or individual's financial operations.

Working Papers

Documents prepared or used by accountants, auditors, or attorneys during an investigation, audit, or litigation, detailing procedures performed and findings.

Q14: The management of activities to improve the

Q19: In general, the lower the response rate

Q21: The percentage of completion of the beginning

Q22: Consider the following for Columbia Street Manufacturing:

Q47: The amount of joint costs allocated to

Q62: Non-financial measures of operations include all the

Q67: After critical success factors (CSFs) have been

Q72: A(n) _ provides evidence to indicate what

Q100: Costs at the unit-level of activity should

Q138: Using ABC, how much product-level overhead is