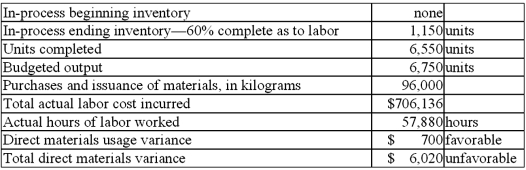

Klash Company adopted a standard cost system several years ago. The company uses standard costs for all of its inventories. The standard costs for direct materials and labor for its single product are as follows: Materials (12 kilograms/unit × $7.00/kilogram) = $84.00/unit; direct labor (8 hours/unit × $12.00/hour) = $96.00/unit. All materials are issued at the beginning of processing. The operating data shown below were taken from the records for December:  Note: number of kilograms issued to production during the period = number of kilograms purchased.

Note: number of kilograms issued to production during the period = number of kilograms purchased.

Required:

1. Calculate the standard cost of the actual kilograms of material purchased.

2. Calculate the total standard kilograms for the production of the period (that is, for "equivalent units produced with respect to direct materials")

3. Calculate the total standard cost of materials for the production of the period.

4. Calculate the actual price per kilogram of material of material purchased this period.

5. Calculate the direct labor rate variance.

Definitions:

Profit-Maximizing

The process or strategy by which a firm determines the price and output level that returns the greatest profit.

Profit-Maximizing Quantity

The production level where a company reaches its maximum profitability.

Consensus

is a group decision-making process where discussions continue until all members agree on a particular solution or decision, highlighting collaboration and collective agreement.

Team Skill

The collective abilities and competencies of a group that contribute to its effectiveness in achieving common goals.

Q4: Jamestown Furniture Co. is a small, but

Q4: Harris Corporation provides the following data on

Q37: One major problem in measuring the productivity

Q40: AirTravel Inc. manufactures a wide variety of

Q48: The estimated internal rate of return (IRR)

Q54: Relevant or differential cost analysis:<br>A)Takes all variable

Q82: The two major contributing factors to a

Q98: Green Leaf Inc. is considering the purchase

Q107: The difference between variable overhead cost incurred

Q163: Under a four-way breakdown (decomposition) of the