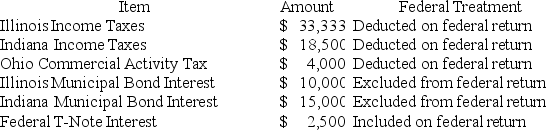

PWD Incorporated is an Illinois corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:  PWD's Federal Taxable Income was $100,000.Calculate PWD's Illinois state tax base.

PWD's Federal Taxable Income was $100,000.Calculate PWD's Illinois state tax base.

Definitions:

Events

Occurrences or actions that can have an impact on the operational, financial, or legal standing of an organization.

Capital Balances

The amount of funds contributed by owners or the net assets available in a business after liabilities have been subtracted.

Net Income

The amount of earnings after subtracting all costs and expenses from revenue, including taxes and other deductions. Representing a company's profit over a specified period.

Monthly Weighted

Refers to averaging or aggregating financial or statistical measures over a month with differing weights applied to the data points, taking into account their relative importance or volume within that period.

Q3: Suppose a calendar year C corporation,NewCorp.,Inc.,was formed

Q8: The annual exclusion eliminates relatively small transfers

Q11: The sales and use tax base varies

Q11: Guido was physically present in the United

Q14: Rainier Corporation,a U.S.corporation,manufactures and sells quidgets in

Q34: SoTired,Inc.,a C corporation with a June 30

Q42: At the end of year 1,Tony had

Q94: The Wrigley case held that the sale

Q119: There are three major types of business

Q151: If a company has excess space in