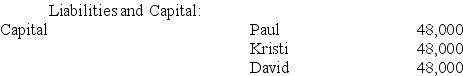

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000.Just prior to the sale,Paul's outside and inside bases in KDP are $48,000.KDP's balance sheet includes the following:

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

Definitions:

Taijin-kyofusho

A Japanese culture-specific syndrome characterized by an intense fear that one's body, body parts, or bodily functions are displeasing or offensive to others.

Amok

A culturally bound syndrome primarily observed in Southeast Asia, characterized by a sudden outburst of violent behavior, often driven by a perceived slight or insult.

Moral Treatment

A historical approach to mental illness that involved treating patients with dignity, in a compassionate and respectful environment.

Psychological Disorders

Patterns of behavioral or psychological symptoms that impact multiple areas of life and/or cause distress to the individual affected.

Q13: ASC 740 is the sole source of

Q24: All 50 states impose a sales and

Q34: Billie transferred her 20 percent interest to

Q39: Grace transferred $800,000 into trust with the

Q51: Most corporations use the annualized income method

Q60: A hybrid entity established in Ireland is

Q69: Brown Corporation reports $100,000 of gain from

Q93: Inca Company reports current E&P of negative

Q111: Suppose at the beginning of 2017,Jamaal's basis

Q135: TrendSetter Inc.paid $50,000 in premiums for life