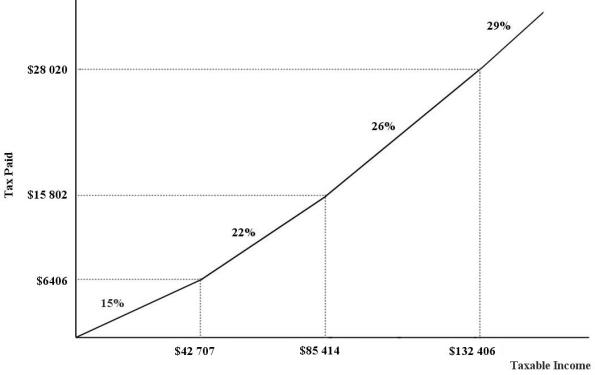

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.What must be true of the four marginal income-tax rates in order for the tax to be considered a "flat" tax?

Definitions:

Low Activity Level

A trait or condition characterized by a lower than average rate of physical movement or actions.

Phlegmatic

A temperament characterized by calmness, reliability, and a relaxed disposition, traditionally one of the four temperaments.

Kohlberg's Moral Reasoning

A theory that proposes the stages of moral development, suggesting that an individual's ability to reason about moral issues advances through distinct stages as they age.

Predictive

Relating to the ability to foretell or forecast future events or behaviors based on current data or past experiences.

Q6: In recent decades the economy has experienced

Q22: A technological improvement in the physical capital

Q33: Refer to Figure 16-1.Suppose that the perfectly

Q51: If a country's population is 15 million

Q55: Refer to Table 18-1.If an individual had

Q61: When computing GDP from the expenditure side,which

Q82: Governments usually provide a system of unemployment

Q101: Transfer payments made by the government affect

Q101: Financial intermediaries are often the "middlemen" between

Q128: Consider the simplest macro model with demand-determined