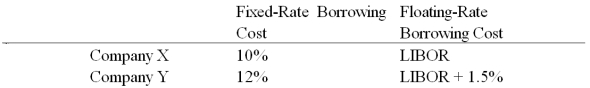

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. What is the value of this swap to company X?

A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. What is the value of this swap to company X?

Definitions:

Correct Order

The proper or desired sequencing of elements, items, or processes according to rules or guidelines.

Recording

The process of entering financial transactions into the accounting records of a business.

Voucher Register

A record of vouchers, which are documents evidencing expenditure or the transfer of funds.

Book Of Vouchers

A ledger or book that contains vouchers, which are documents or files acting as evidence for transactions.

Q12: The conflicts between the upstream and downstream

Q27: Under which method does the gain or

Q45: Operational risk refers to the risk which

Q49: Many MNCs involved in extractive/natural resources industries<br>A)tend

Q53: In general,Standard & Poor's Emerging Markets Data

Q58: In what year were U.S.MNCs mandated to

Q66: Adler and Simon (1986)examined the exposure of

Q77: The record of investing in U.S.-based international

Q85: Pricing an interest-only single currency swap after

Q86: In terms of the types of instruments