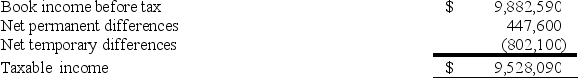

B&B Inc.'s taxable income is computed as follows.

B&B's tax rate is 34%.Which of the following statements is true?

B&B's tax rate is 34%.Which of the following statements is true?

Definitions:

Double Contrast

A radiographic technique that uses two contrasting agents (one positive and one negative) to improve image quality in diagnostic imaging.

Crystals

Solid materials whose atoms are arranged in highly ordered, repeating patterns extending in all three spatial dimensions.

Barium Enema

A diagnostic imaging procedure that involves filling the colon with a liquid barium solution to help visualize the colon and rectum on an X-ray.

Upper GI Series

A series of radiographs of the esophagus, stomach, and small intestine taken after swallowing a contrast material to diagnose conditions and abnormalities.

Q3: Wilson Company has $100,000 in an investment

Q12: In its current tax year,PRS Corporation generated

Q25: Which of the following tax policies would

Q34: Perry Inc.and Dally Company entered into an

Q38: Tax law uncertainty is the risk that

Q66: Goff Inc.'s taxable income is computed as

Q79: Tatun Inc.pays state income tax at a

Q87: Ms.Alfred anticipates that her business will generate

Q89: Which of the following statements concerning the

Q95: Elakin Inc.,a calendar year taxpayer,paid $1,339,000 for