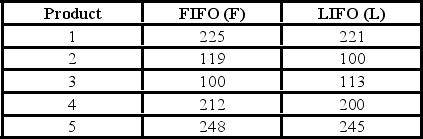

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  If you use the 5% level of significance,what is the critical t-value?

If you use the 5% level of significance,what is the critical t-value?

Definitions:

Early Experience

Refers to the influential effects that events and environments have on an individual during the early stages of their development.

Waggle Dance

A behavior exhibited by honeybees to communicate the direction and distance of food sources to other members of the colony.

Scout Bee

A worker bee that searches for new sources of food or a new location for the hive and then communicates this information to the colony.

Food Supply

The provision and availability of food materials to organisms, ensuring their nourishment and survival.

Q6: If the null hypothesis is false and

Q8: What kind of distribution is the t-distribution?<br>A)Continuous<br>B)Discrete<br>C)Subjective<br>D)A

Q15: The annual dividend rates for a random

Q30: The probability of a particular event occurring,given

Q34: The finite population correction (FPC)factor is used

Q35: When dependent samples are used to test

Q37: Which approach to probability is exemplified by

Q37: A survey of 50 retail stores revealed

Q41: A recent study focused on the amount

Q75: Using the following data,the Wilcoxon signed-rank hypothesis